Investing Etiquette - all about the ESG

Photo: Getty Images

As the world heats up, so too does one particular corner of the financial market; sustainable investment funds. Environmental, social and governance considerations (ESG) are driving traditional investing into oblivion, and it is the customers, consumers, the investors who are driving this (most probably in an electric vehicle). Also known as “socially responsible investing”, “impact investing” and “sustainable investing”, ESG compliancy means that investments are made in companies and organisations which keep consideration of the environment, human wellbeing and the economy at their core. Investing is becoming more a tool to vote with one’s money, to actively put oneself behind their beliefs and the factors to consider when doing so are becoming much broader. This progressive, holistic shift has undoubtedly led to increased investor awareness about ethical movement in the market and is undoubtedly booming on the back of the COVID pandemic, climate change and a cultural shift due to the resilience of such funds against conventional market disruptions.

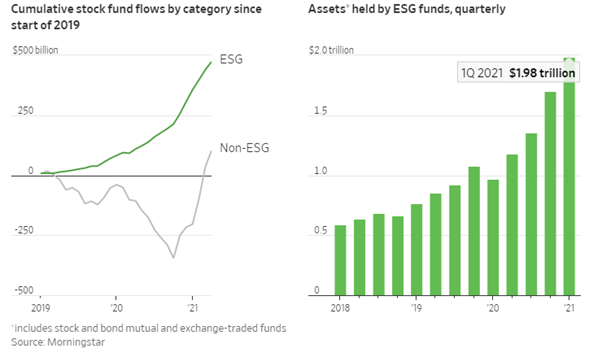

Whilst this has been building over some time, there is now more scrutiny as companies and fund managers have to do more than just tick a box or preach a policy. Amid the gushing flow of green- washing and happenstance there is more information, stricter credibility tests and above all, intentionality. Investors actively want to make a positive change, they want to invest in companies that are making a difference and they want to invest in companies working across all three domains. Along with progressively higher returns on investment as they, quite literally, weather the storm (drought or bushfire, take your pick), portfolios incorporating ESG, and sustainability frequently perform better long-term than those that don’t. US financial services firm Morningstar, found that over 10 years, 80% of blend equity funds investing sustainably outperform traditional funds and 77% of ESG funds survived over 10 years compared to 46% of traditional funds that lasted the same amount of time. This is emphasising the fact that these companies are meant to last. Sustainability is the ability to be maintained; to meet the needs of the present without compromising those of the future. The cataclysmic climate situation is felt reverberating from younger generations and to reflect these evolving societal values and norms, it is imperative that organisations adopt forward-looking ESG practices and consider their carbon footprint if they want to run with the (grass fed, hormone-free) bulls. There is newfound awareness in the supply chain involving human rights, and labour costs, right through to the board and its proportion of equal opportunities and workplace diversity, accompanying a heightened engagement of groups that may have previously been less prevalent in traditional investing such as young people and women (who are now contributing strongly to the ESG explosion).

A high percentage of women and millennials say they are interested in ESG investing while financial advisers aren’t responding yet. Source: Morningstar

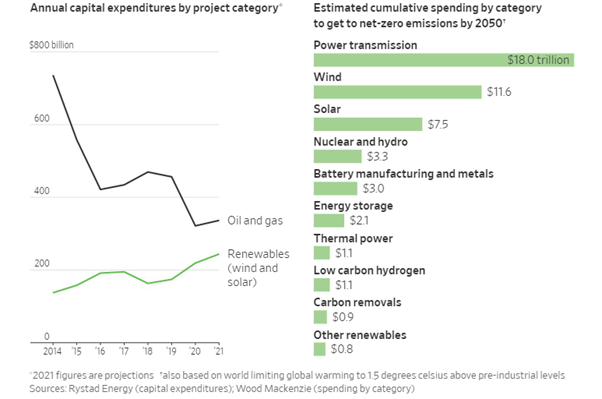

One would struggle to find an area of business where ESG is not applicable, however some ESG issues are prioritised more than others which is the nature of the game depending on the company, their given industry, geography and specific circumstance. The increasing grey area concerning a company that may have poor ESG credentials but actively transitioning, for example from fossil fuels to renewables is becoming increasingly large and contentious for those investors who are engaging, voting and trying to influence those companies to evolve their business. “Companies perform better when they are deliberate about their role in society and act in the interests of their employees, customers, communities and their shareholders” BlackRock, 2021 who vote against the re-election of directors if companies they’re investing in are not addressing ESG risks.

With nearly $200 billion worth of new money being poured into ESG-labelled products globally and with ESG investing up 18%, making a twofold jump since October 2019, “investing without a consideration of environmental, social and governance (ESG) is almost no longer tenable in Australia or globally”. It’s like saying no to a beer on a Friday, you just wouldn’t do it (maybe need a better metaphor).

More stats from Morningstar below